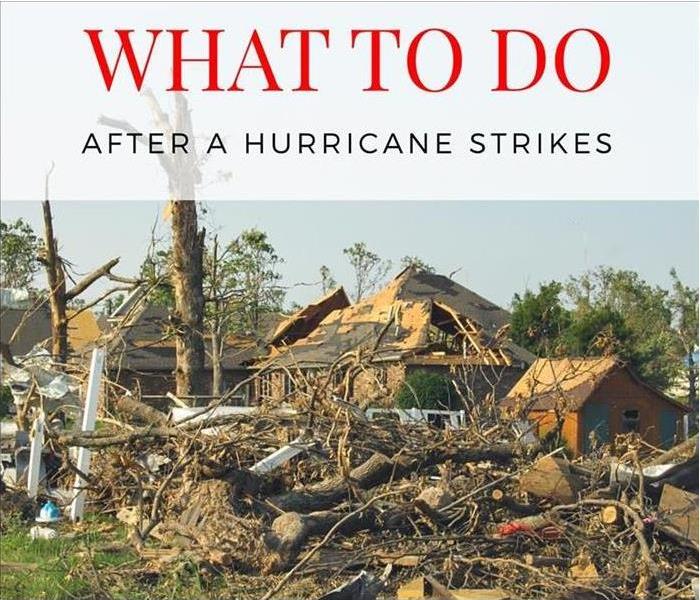

What to Do After a Hurricane Strikes

8/26/2021 (Permalink)

Hurricanes can be devastating, and to many Brevard County residents, Irma was just that. If your home had damages caused by the hurricane, here are the immediate steps you should take.

Photograph and Document Damage

Dealing with your insurance company is not always a walk in the park, but by documenting your damages, the process can go a lot smoother. Take photos of all damages, both inside and outside of your home. Also create a list of all damaged contents inside your home such as water damaged furniture.

Conduct Emergency Repairs

In many insurance policies, it suggests it is your responsibility to stop any future damages from occurring. For example, if you have a large hole in your roof, you need to place a tarp over the hole to prevent rain and other elements from causing further damages. Don’t make any permanent repairs until your insurance adjusters come out to reviews your home’s damages.

Secure Home Inventory

By securing your home inventory, this will help your claim process go much easier. A home inventory is a document detailing all your possessions in the home. Your inventory should include photos, detailed descriptions, and if possible, the item’s receipts.

File a Claim ASAP

If you experienced damages to your home from the hurricane, you should file a claim immediately. Be prepared to explain all the damages that occurred to your home in detail. This will help your insurance provider in starting your initial claim, and they can also provide you with some advice while waiting for your adjuster to come and assess the damages firsthand.

Secure Safe Lodging

If your home is damaged to the extent where it is no longer fit to live in, you will need to secure a place for you and your family to stay in the meantime. Check your insurance policy to see if you have coverage for temporary lodging while your home is being repaired. In standard homeowner’s insurance policy, this is typically covered as long as the overall damage to your home is part of the covered insurance claim.

24/7 Emergency Service

24/7 Emergency Service